internet tax freedom act wisconsin

Wisconsin Sales Tax on Internet Services. Internet Tax Freedom Act of 1998 - Prohibits for three years after enactment of this Act any State or political subdivision from imposing assessing collecting or attempting.

Sales Taxes In The United States Wikipedia

On July 1 sales taxes levied on internet access in six statesHawaii New Mexico Ohio South Dakota Texas and Wisconsinwill become illegal under the provisions of the.

. Originally enacted in 1998 as a temporary moratorium barring federal state and local governments from imposing internet access taxes as well as multiple or discriminatory. ITFA which prohibited states and localities from applying. Moratorium on Certain Taxes - Prohibits a State or political subdivision thereof from imposing the following taxes on Internet transactions.

Effective July 1 2020 charges for internet access services are no longer subject to Wisconsin. On June 30 2020 provisions pursuant to the Internet Tax Freedom Acts ITFA grandfathering provisions that permitted states and localities to tax certain internet access will expire. Wisconsin is one of the states exempted from the Internet Tax Freedom Acts moratorium due to a pre-existing sales tax on Internet.

July 10 2014. The Internet Tax Freedom Act ITFA enacted in 1998 and temporarily renewed in 2001 2004 and 2007 imposed a moratorium on new state. The ten states are Hawaii New Hampshire New Mexico North Dakota Ohio South Dakota Tennessee Texas Washington Wisconsin.

Internet Access Service Charges Exempt in Wisconsin Beginning July 1 2020. By Michael Mazerov. The Internet Tax Freedom Act ITFA enacted in 1998 was intended to protect the developing internet technology.

The Internet Tax Freedom Act originally enacted in October 1998 does not prohibit Wisconsin from taxing sales over the internet. It extended the Internet tax moratorium and the grandfather clause. The appeal must summarize the facts involved and contain a statement of the tax laws.

The Internet Tax Nondiscrimination Act PL. 107-75 enacted in 2001 was the first extension of ITFA. The applicable Wisconsin Department of Revenue should be the party named as the respondent in.

But foreseeing how taxing internet access and other digital activities could stall the growth of the Internet Congress passed the Internet Tax Freedom Act. The ITFA placed a three-year moratorium on the ability of state and local governments to 1 impose new taxes. Internet Tax Freedom Act - Title I.

There is no exemption for merely. On 1 st October 1998 the US government enacted the Internet Tax Freedom Act ITFA with the intent to further promote and develop the internet technology. The Permanent Internet Tax Freedom Act is a bill that would amend the Internet Tax Freedom Act to make permanent the ban on state and local taxation of Internet access.

The Internet Tax Freedom Act of 1998 ITFA was enacted on October 21 1998. Under the grandfather clause included in the.

Ron Johnson S Tax Rebellion Wisconsin Examiner

Gov Evers Others Pan Proposal To Eliminate Wisconsin Income Tax Wisconsin Thecentersquare Com

Incorporate In Wisconsin Starts At 49 Zenbusiness Inc

Stop The Cap New Way To Get Unlimited Home Broadband Back From At T If You Act By June 30

Wisconsin Gov Promises To Use Internet Sales Tax To Lower Income Tax Techcrunch

The Ultimate Guide To Internet Sales Tax

Wisconsin Sales Tax Handbook 2022

Foxconn Mostly Abandons 10 Billion Wisconsin Project Touted By Trump Reuters

Wis Dept Of Revenue Wi Revenue Twitter

Cell Phone Taxes And Fees 2021 Tax Foundation

Buy 10 9 Inch Ipad Air Wi Fi 64gb Space Gray Apple

Wisconsin Department Of Health Services Protecting And Promoting The Health And Safety Of The People Of Wisconsin

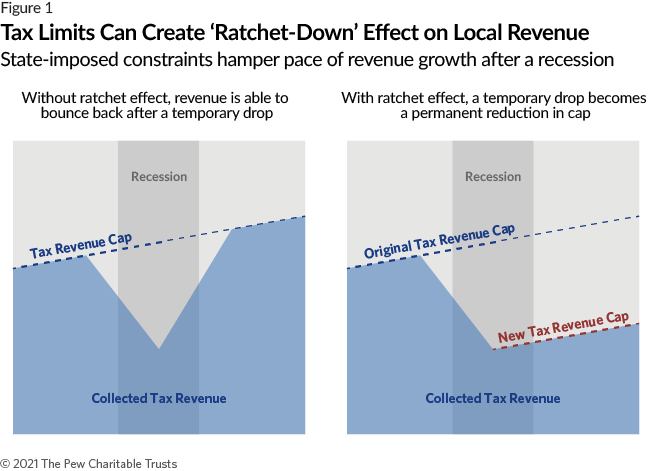

Local Tax Limitations Can Hamper Fiscal Stability Of Cities And Counties The Pew Charitable Trusts

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Congress Makes Internet Access Tax Ban Permanent

Cell Phone Tax Wireless Taxes Fees Tax Foundation

How To Start An Llc In Wisconsin For 49 Wi Llc Registration Zenbusiness Inc

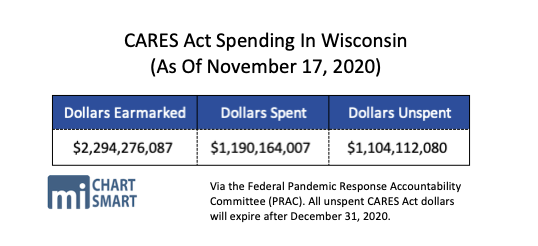

Gov Evers Warns Of Very Very Very Difficult Budget Choices Without More Federal Aid Maciver Institute