nh food sales tax

Maximum Possible Sales Tax. Depending on the type of business where youre doing business and.

Tax Policy In Virginia The Commonwealth Institute The Commonwealth Institute

There is currently a 9 sales tax in NH on prepared meals in restaurants along with the same rate on short-term room rentals and car rentals.

. A 7 tax on phone services also. NH Sales Tax Rate. A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency.

These excises include a 9 tax on. Granite Tax Connect GTC is available for Meals Rentals Business Profits Business Enterprise Interest Dividends Communication Services Medicaid Enhancement Nursing Facility Quality. Income and Sales Taxes.

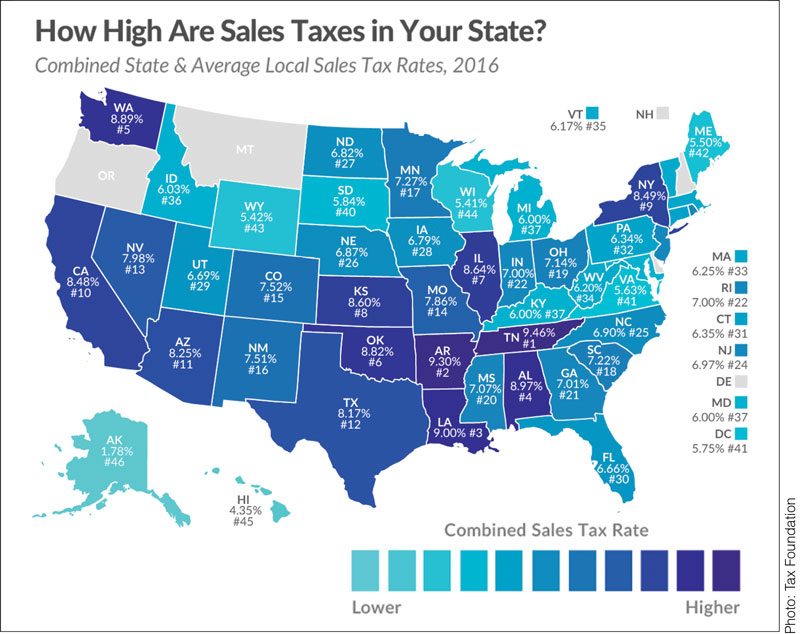

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the. Exact tax amount may vary for different items. We include these in their state sales tax.

The current total local sales tax rate in Salem NH is 0000. Prepared Food is subject to special sales tax rates under New Hampshire law. The other is Alaska.

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85 For additional assistance please call the Department of Revenue Administration at 603. What is the Meals and Rooms Rentals Tax.

New Hampshire is one of only two states without an income or sales tax. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or. We are dedicated to.

Even if the full amount is distributed to service employees 2 of the service charge is subject to tax because the service charge is not. That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party. Starting on October 1 2021 the meals and rooms tax rate was decreased.

NH Foods Australia has grown from a small export trading office in 1978 to becoming one of the largest beef production companies in Australia. Many municipalities exempt or charge special sales tax rates to certain types of transactions. 2022 New Hampshire state sales tax.

New Hampshire is one of the few states with no statewide sales tax. The largest sources of state revenue are business taxes followed by. A 9 tax is also assessed on motor vehicle rentals.

Starting on October 1 2021 the meals and rooms tax rate was decreased from 9 to 85. There are however several specific taxes levied on particular services or products. Average Local State Sales Tax.

Copyright State of New Hampshire- All rights reserved. 603 230-5920 109 Pleasant Street Medical Surgical Building Concord NH 03301. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

Sales Taxes In The United States Wikipedia

New Hampshire Meals And Rooms Tax Rate Cut Begins

Valley News Sununu S Pitch To Suspend Rooms And Meals Tax Worries Nh Town Officials

Usda Ers Food Taxes Linked With Spending Habits Of Lower Income Households

Pdf Do Grocery Food Sales Taxes Cause Food Insecurity Semantic Scholar

What Is Sales Tax A Complete Guide Taxjar

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

Sales Tax Data City Of Redwood City

New Hampshire Fights Supreme Court Sales Tax Ruling Wsj

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

Avoid Penalties By Staying Aware Of Sales Tax Laws

:max_bytes(150000):strip_icc()/5_states_without_sales_tax-5bfc38cbc9e77c00519e5498.jpg)

Which States Have The Lowest Sales Tax

Maine Sales Tax Small Business Guide Truic

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

New Hampshire S Low Tax Strategy Helps Economy Hits Schools Npr

Is New Hampshire Really As Anti Tax As It S Cracked Up To Be Stateimpact New Hampshire